Bilt Mastercard®

FINALLY. A CREDIT CARD THAT LETS

YOU EARN POINTS ON RENT.1

AND MORE.

Offers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply now to take advantage of this offer.

REDEEM THE

MOST VALUABLE REWARDS

Bilt Points ranked as the most valuable rewards points (above Amex Membership Rewards and Chase Ultimate Rewards), by Bankrate.com

BEST

NO-ANNUAL-FEE

CREDIT CARD

Winner of The Points Guy 2023 Readers’ Choice Awards for “Best No-Annual-Fee Credit Card”

1X POINTS ON RENT

PAYMENTS WITHOUT THE TRANSACTION FEE.1

Finally you can pay rent and get rewarded without the transaction fee.

For example:Rent

$2,000

Card transaction fee (3%)

Waived for Bilt cardholders

old price $60

Illustrative

Even if your property only accepts

checks, you can still pay with your credit

card through the Bilt app and we’ll send

a check on your behalf.

2X POINTS ON TRAVEL1

Elevate the way you travel.

Earn 2X points on travel booked directly with airlines, hotels, cruise lines, and car rental agencies.

TRAVEL BENEFITS AND FEATURES:

Receive reimbursement for the nonrefundable cost of your common carrier fare if your trip is canceled or interrupted for a covered reason.3

Get reimbursed for eligible expenses incurred if a trip is delayed over six hours --benefit amount up to $200 per day, per traveler; maximum of $1,800 for all covered travelers.4

Pay for rental transactions with an eligible card and receive reimbursement of up to $50,000 if covered damage to or theft of your eligible rental vehicle occurs.5

No foreign transaction fee

When you use your card for travel, you won’t pay a foreign transaction fee for purchases converted to U.S. dollars.

Take 3 eligible rides with your Bilt World Elite Mastercard® in a month and earn $5 in Lyft credit.6

3X POINTS ON DINING1

Dine like a royal and earn 3X points whether you’re at your favorite restaurant, lounge, or ordering in.

DINING BENEFITS AND FEATURES:

Whether you need hard-to-find dinner reservations, the perfect last-minute gift or insider hotel recommendations, the World Elite Mastercard Concierge will work behind the scenes on your behalf — anywhere in the world.7

1X POINTS ON OTHER PURCHASES1

And it doesn’t stop there.

ADDITIONAL CARD BENEFITS

Get up to $800 of cell phone protection per claim against damage, theft, and unintended separation when you pay your monthly phone bill with an eligible card. Subject to a $25 deductible.8

Get reimbursed for the cost to repair or replace an item purchased with your Bilt Mastercard in the event of covered damages or theft within 90 days of purchase.9

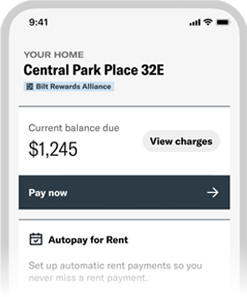

Protect your available credit

with BiltProtect

BiltProtect lets you pay rent without using your credit limit, by pulling the full rent payment directly from a linked bank account. By using BiltProtect, you agree to the Terms & Conditions.10 You still earn 1X points on rent payments. Use the card 5 times per statement period to earn points, up to 100,000 points per calendar year.1 Terms apply

BILT REWARDS

Use your points for all your favorite Bilt Rewards redemptions.

Points earned with the Bilt Mastercard® will also count towards your Bilt Rewards status.

Travel

Transfer your points 1:1 to one of our many world-class partners.

Rent and down payment

Use your Bilt points towards a credit on your month’s rent payment or save your points and put them towards a down payment - with the first rewards program of its kind to let you redeem rewards points towards homeownership.

Fitness

We’ve partnered with the nation’s top group fitness classes so you can redeem your points for some of the most popular classes – starting at just 1,600 points a class.

The Bilt Collection

With the Bilt Collection,

you’ll have exclusive access to

our hand-curated catalogue

of art, decor, and apparel —

all inspired by that month’s featured artist.

"If you’re looking for a way to earn rewards on rent payments, this card is the obvious choice. It not only earns points on rent, but also waives the fees that typically come with paying rent with a credit card."

“For any renter, the Bilt Rewards program and Bilt Rewards Mastercard® is a no-brainer. Bilt allows you to capitalize on the routine rent payments you already make each month by earning points.”

“In an industry where lots of credit cards share many of the same features, the Bilt Mastercard is a rare product that has a compelling feature that no other card is currently able to offer."

Other things you need to know

Other things you need to know footnotesOffers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply now to take advantage of this offer.

Refer to the Bilt World Elite Mastercard® Credit Card Account Agreement, Bilt World Elite Mastercard® Credit Card Rewards Program Agreement (the "Card Rewards Program") Terms and Conditions ("Terms"), Bilt Rewards Terms & Conditions, and the Bilt World Elite Mastercard® Credit Card Guide to Benefits to learn more.

This offer is not a guarantee of credit. Credit card is subject to credit qualification.

You may not be eligible for this product if you currently have an open Bilt Mastercard account.

Footnote 1. When you make at least 5 transactions in a statement period using your Bilt Mastercard, you’ll earn points on rent and qualifying net purchases (purchases minus returns /credits) for that statement period. Rent: You'll earn 1 rewards point per $1 spent on rent paid through the Bilt App or website with your card account up to a maximum of One Hundred Thousand (100,000) points each calendar year. If your rent payment is less than $250, you will earn 250 points for that rent payment. Rent payments can only be made to one rental property per month. Travel: 2 rewards points (1 base point plus 1 bonus point) are earned per $1 spent on qualifying net purchases made directly at retailers whose Merchant Code for Mastercard is classified as airlines, hotels, motels, resorts, cruise lines, and car rental agencies. Dining: 3 rewards points (1 base point plus 2 bonus points) are earned per $1 spent on qualifying net purchases at retailers whose Merchant Code for Mastercard is classified as eating places and restaurants, drinking places, bakeries, or fast food restaurants. Purchases not processed using the Merchant Codes for Mastercard mentioned above will not qualify for bonus points. Wells Fargo does not have the ability to control how a retailer chooses to classify their business and therefore reserves the right to determine which purchases qualify for bonus points. The following purchases and transactions are excluded from earning bonus points: tax payments, third party payment accounts, at online marketplaces, with retailers who submit purchases using a mobile or wireless card reader or if you use a mobile or digital wallet. You may not earn bonus points for purchases made through third-party payment accounts, at online marketplaces, with retailers who submit purchases using a mobile/wireless card reader, or if you use a mobile or digital wallet. Other purchases: 1 rewards point will be earned per $1 spent on other qualifying net purchases. If you do not make at least 5 transactions in a statement period you’ll earn a flat 250 points when you use your Bilt Mastercard to pay rent through the Bilt App or Website. ATM charges, cash advances, traveler’s checks, money orders, pre-paid gift cards, Balance Transfers, wire transfers, fees or interest posted to your card account such as returned payment fees, late fees, monthly or annual fees, bets or wagers transmitted over the internet, and casino gaming do not earn points. Refer to the Bilt World Elite Mastercard® Credit Card Rewards Program Agreement (the "Card Rewards Program") Terms and Conditions ("Terms") for details. ←back to content

Footnote 2. When you make at least 5 transactions in a statement period using your Bilt Mastercard®, you’ll earn double points on qualifying net purchases (purchases minus returns /credits), excluding rent, for this promotional offer.

This promotional offer is valid on the 1st day of the month, from 12:00am ET through 11:59pm PT. For a purchase to qualify for this offer, the transaction must be made and the merchant must submit charges to your credit card on the first day of the month. You will earn 6 rewards points (3 bonus points) for every $1 spent on net dining purchases (purchases minus returns/credits), 4 rewards points (2 bonus points) for every $1 spent on net travel purchases (purchases minus returns/credits), and 2 rewards points (1 bonus point) for every $1 spent on net purchases outside of rent, travel, and dining (purchases minus returns/credits), subject to the Bilt World Elite Mastercard® Credit Card Rewards Program Agreement (the "Card Rewards Program") Terms and Conditions ("Terms"). The following purchases and transactions are excluded from earning bonus points: tax payments, third party payment accounts, at online marketplaces, with retailers who submit purchases using a mobile or wireless card reader or if you use a mobile or digital wallet.

The maximum amount of bonus points you can earn under this promotion is 1,000 per month, regardless of how much you purchase. Purchases not processed using the Merchant Codes for Mastercard® mentioned above will not qualify for bonus points. Wells Fargo does not have the ability to control how a retailer chooses to classify their business and therefore reserves the right to determine which purchases qualify for bonus points. It may take up to seven (7) days for bonus points earned through this offer to post to your account upon making the 5th transaction in a statement period. To qualify for this promotional offer, your Bilt Mastercard® account must be open and not in default at the time of fulfillment. Should you receive points on an ineligible purchase, Bilt may deduct those points at its discretion. For more information, refer to the Bilt Rewards Terms & Conditions.

This promotion cannot be combined with other promotions or offers unless otherwise stated. Bilt will determine the best promotion applicable for purchases posted to your Bilt Mastercard account. ←back to content

Footnote 3. Coverage provided by this benefit is secondary. Cardholders are eligible for reimbursement for the cost of the nonrefundable scheduled common carrier passenger fare in the event the trip must be canceled or interrupted because of a covered reason. The entire fare, less redeemable certificates, vouchers, or coupons, must be paid with your Bilt World Elite Mastercard® and/or Bilt Rewards program associated with your covered account. A maximum benefit amount and certain restrictions and limitations apply. Please review the Bilt World Elite Mastercard® Credit Card Guide to Benefits for details. ←back to content

Footnote 4. Coverage provided by this benefit is secondary. Covers trip delay expenses incurred after the initial delay of six (6) hours when a trip delay is caused by an eligible reason. Coverage begins on the trip departure date and ends on the trip completion date. Eligible trip delay expenses are covered for you, your spouse or domestic partner and your dependent children traveling on the trip, when you charge the covered traveler’s common carrier fare to your eligible Wells Fargo credit card. For New York residents, your eligible Wells Fargo credit card must be used to pay for the expenses incurred during the delay. A maximum benefit amount and certain restrictions and limitations apply. Please review the Bilt World Elite Mastercard® Credit Card Guide to Benefits for details. ←back to content

Footnote 5. Coverage provided by this benefit is primary (except for New York Residents). In order for coverage to apply, you must pay for all of the cost to rent the car with your Bilt World Elite Mastercard® and/or Bilt rewards program associated with your covered card account. Cardholder must decline coverage from the rental company to be eligible for this benefit. Certain vehicles are not covered. A maximum benefit amount and certain restrictions and limitations apply. Please review the Bilt World Elite Mastercard® Credit Card Guide to Benefits for details. ←back to content

Footnote 6. Take 3, Get $5: Beginning 4/1/21 and running through 1/31/26, Lyft users can participate in Lyft and Mastercard's Take 3, Get $5 program ("Program") by taking and partially or fully paying for three (3) Eligible Rides in a calendar month to receive a $5 Lyft credit ("Credit"). The rides must be paid for with an eligible World or World Elite Mastercard credit card. Limit one Credit per calendar month per Lyft account. An "Eligible Ride” is any Lyft ride type, excluding business rides and bicycle and scooter rental rides. Valid only in the U.S. Whether a ride qualifies as an Eligible Ride for purposes of the Credit will be determined in Lyft’s sole discretion. Credits expire 30 days after application. Limited time only and while supplies last. By participating in the Program, you agree to these terms and Lyft's Terms of Service (https://www.lyft.com/terms), and you agree that Lyft and Mastercard may share your information for the purposes of tracking and processing the Credit and may use anonymized, aggregated data for business analytics and offer optimization. Credits may take up to 2 days to be applied to your Lyft account. ←back to content

Footnote 7. This benefit may be subject to change without prior notice. Please visit www.mastercard.us/worldelite or call 1-800-Mastercard (1-800-627-8372) for the latest benefit information. ←back to content

Footnote 8. Cellular Telephone Protection can reimburse the Bilt World Elite Mastercard® Credit Card cardholder for damage to, theft of, or involuntary and accidental parting of a cell phone. This is supplemental coverage not otherwise covered by another insurance policy (for example, cell phone insurance programs, or your homeowner’s, renter’s, automobile, or employer’s insurance policies) and may be applied after all other insurance is exhausted. Reimbursement is limited to the cost to repair or replace your original cell phone, less a $25 deductible with an allowable maximum of two paid claims per 12-month period. Each approved claim has a benefit limit of $800. This benefit does not cover cell phones that are lost (i.e., mysteriously disappear). This protection is only available when cell phone bills are paid with a Bilt World Elite Mastercard® Credit Card. Eligible cell phones are the lines listed on your most recent cellular wireless service provider’s monthly billing statement for the billing cycle prior to when the incident occurred. Electronic failure or issues related to the software of the device are not covered. Cellular Telephone Protection coverage begins the first day of the calendar month following the payment of your first cell phone billing using your Bilt World Elite Mastercard® Credit Card, and remains in effect when you continue to charge your total monthly cell phone bill to your Bilt World Elite Mastercard® Credit Card. This protection may not be equivalent to or better than other applicable coverage. For complete coverage benefits and exclusions regarding this protection, refer to the Guide to Benefits.

Note:

Call your cellular provider (or sign on to their website) and request to set up automatic payments. Setting up automatic payments is not required to qualify for Cellular Telephone Protection; however, you need to pay your monthly cell phone bill with your Bilt World Elite Mastercard Credit Card to get up to $800 protection. ←back to content

Footnote 9. Coverage provided by this benefit is secondary. Benefit may be used in the event of theft or damage of the eligible item. Theft or damage must occur within the first ninety (90) days from the date of purchase, and eligible item must be purchased entirely with your Bilt World Elite Mastercard®. A maximum benefit amount and certain restrictions and limitations apply. Please review the Bilt World Elite Mastercard® Credit Card Guide to Benefits for details. ←back to content

Footnote 10. When BiltProtect is enabled, you can initiate a BiltProtect Rent ACH transaction to use your Bilt Mastercard to pay your monthly rent by transferring funds from a linked qualifying deposit account. A BiltProtect Rent ACH is not a credit card purchase transaction. Remember to make 5 transactions that post to your account each statement period to earn points. For funds to transfer, you must link a qualifying deposit account on the Bilt app or the Bilt Rewards website. For more information, review the Bilt World Elite Mastercard® Credit Card Account Agreement. ←back to content

Bilt World Elite Mastercard® is issued and administered by Wells Fargo Bank. N.A., pursuant to a license from Mastercard. Mastercard is a federally registered service mark of Mastercard.

LRC-0525