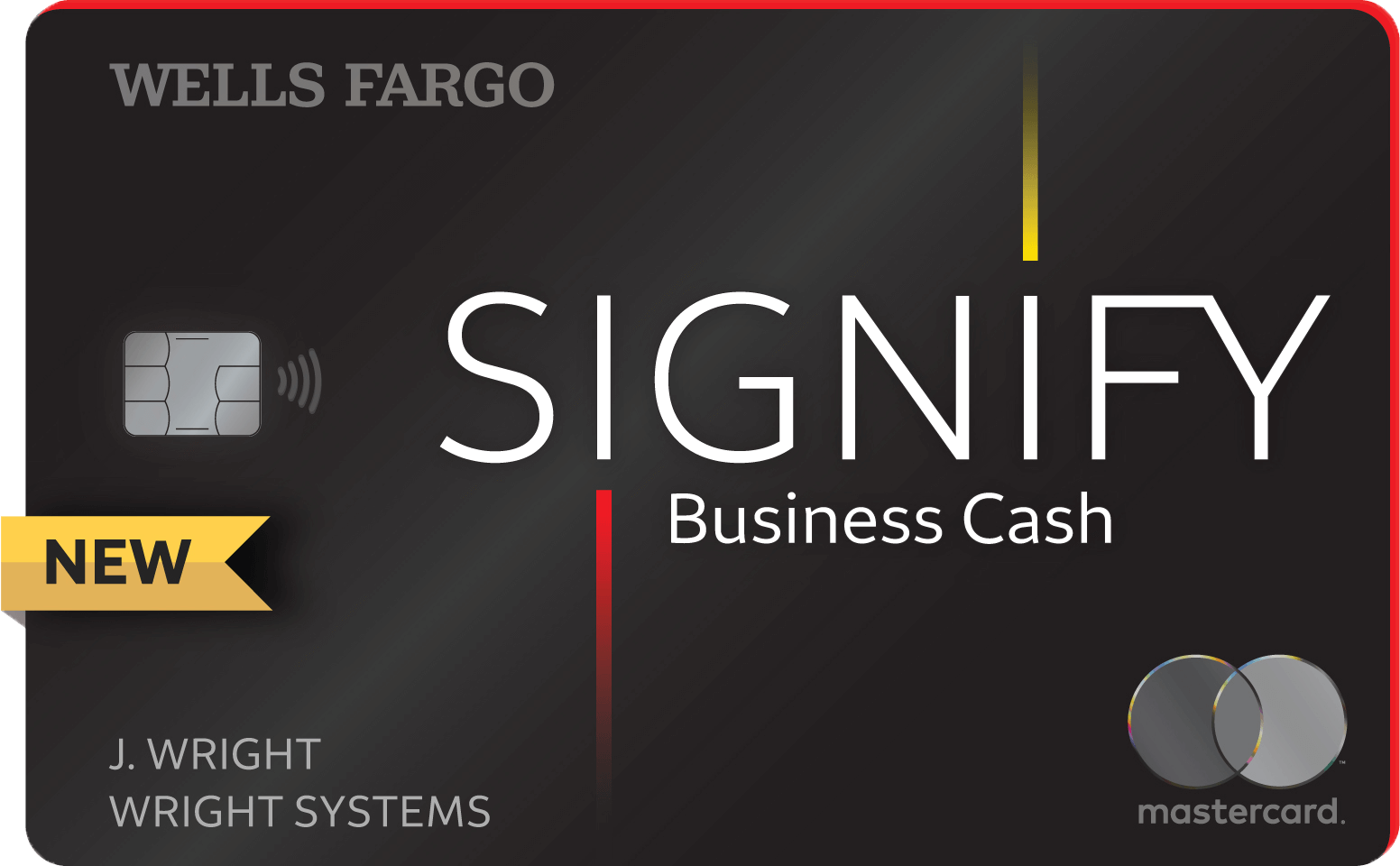

Signify Business Cashservice mark Card by Wells Fargo

Earn a $500 cash rewards bonus

when you spend $5,000 in purchases for your business in the first 3 months.1

Don’t miss out on these offers as they can vary over time and through different communication channels such as email, mail, online, phone or in a branch.

Apply now on this page to take advantage of these offers.

Now running your business is even more rewarding

Unlimited2%

Earn unlimited 2% cash rewards

on purchases made for your business with no categories to track, and no limit to the amount of rewards you can earn2

$0Annual Fee

No annual fee

in addition to the rewards

you can earn

12Months

0% intro APR for 12 months

from account opening on purchases.

After that your variable APR will be

18.49% – 26.49%.

Business card

features and benefits

Autopay

Make sure your credit card is paid on time by scheduling automatic payments.5

Account Alerts

Stay informed of important activity

on your account and on employee

cards with customizable alerts.6

Digital Wallets

Choose the digital wallets you

would like to use to make payments

quickly and securely. Get started in

the Wells Fargo Mobile® app.7

Online Banking

With Wells Fargo Business Online®,

you have secure online access to

your accounts through your

desktop and mobile devices.6

Redeem to account

Rewards can be used to credit eligible accounts.8

Redeem for travel

Redeem your rewards on flights,

car rentals, and hotel stays for your

next business trip.

Redeem for gift cards

Find the perfect gift card for that right

occasion. Gift cards are redeemable in

many amounts.

Priority PassTM

Complimentary membership access

to

more than 1,300 participating

airport lounges worldwide with “pay

as you go” lounge visit fees.11

Worldwide Automatic Common Carrier Travel

Accident Insurance

Purchase your airline or other common carrier ticket with

your eligible Wells Fargo card and you can be protected

with Travel Accident Insurance of up to $250,000.12

MasterRental Insurance

Coverage

Reimbursement for covered physical damage and/or theft of a rental vehicle with primary protection.13

Zero Liability Protection

Built-in protection features ensure that

you won't

be held responsible for unauthorized transactions,

as long as

they're reported promptly.9

Mastercard ID Theft ProtectionTM

Detection and protection against identity theft, including monitoring, alerts and expert resolution 24/7/365. Enrollment is required.10

Cash back calculator

*Cash back is earned in the form of cash rewards. Monthly spending and yearly total values are for illustrative purposes only.

Other things you need to know

Read the Wells Fargo Signify Business CashSM Credit Card Account Agreement and the Wells Fargo Signify Business CashSM Guide to Benefits to learn more.

Credit card is subject to credit qualification.

Footnote 1. To qualify for the $500 cash rewards bonus a total of at least $5,000 in qualifying purchases (purchases minus returns/credits) must post to your account within 3 months from the date your account is opened. These bonus cash rewards will show as redeemable within 1 – 2 billing periods after they are earned. Cash advances of any kind do not earn rewards and may affect the credit line available for this offer. ATM charges, cash advances, traveler’s checks, money orders, pre-paid gift cards, wire transfers, fees or interest posted to your card account such as late fees, foreign currency conversion fees, bets or wagers transmitted over the internet, casino gaming chips, lottery tickets, off-track wagers, do not earn cash rewards. Refer to the Summary of the Wells Fargo Business Rewards Program Terms and Conditions for the Signify Business CashSM Credit Card for more information about the rewards program.←back to content

Footnote 2. 2% cash rewards are earned for every $1 spent in qualifying purchases (purchases minus returns/credits) on the credit card account. ATM charges, cash advances, traveler’s checks, money orders, pre-paid gift cards, wire transfers, fees or interest posted to your card account such as late fees, foreign currency conversion fees, bets or wagers transmitted over the internet, casino gaming chips, lottery tickets, off-track wagers, do not earn cash rewards. Refer to the Summary of the Wells Fargo Business Rewards Program Terms and Conditions for the Signify Business CashSM Credit Card for further details. ←back to content

Footnote 3. Account Guarantors are responsible for repayments of all debts on the account, including all transactions made by Employee Cardholders. ←back to content

Footnote 4. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. ←back to content Return to Footnote 4

Footnote 5. Terms and Conditions apply. When you enroll in the automatic payment service, you must be the owner of the business or personal deposit account. If payment is returned or reversed for any reason, or results in an Overdraft Protection Advance from the designated deposit account, we may terminate the automatic payment service without notice and/or close your Account. Please refer to the Wells Fargo Signify Business CashSM Credit Card Account Agreement for more information. ←back to content

Footnote 6. Sign-up may be required. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's message and data rates may apply. ←back to content

Footnote 7. Terms and conditions apply. Some (but not all) digital wallets require your device to be NFC (Near Field Communication) enabled and to have the separate wallet app available. Your mobile carrier’s message and data rates may apply. ←back to content

Footnote 8. Rewards redeemed as a credit to an eligible Wells Fargo business credit product are applied toward your principal balance. You must still make regularly scheduled payments. ←back to content

Footnote 9. You won't be held responsible for promptly reported unauthorized transactions, subject to certain conditions. For more information, please review the applicable Wells Fargo Signify Business CashSM Credit Card Customer Agreement and Disclosure Statement. ←back to content

Footnote 10. Certain terms, conditions, and exclusions apply. Cardholders need to register for this service. This service is provided by Iris® Powered by Generali. Please refer to your Guide to Benefits for details, or call 1-800-Mastercard (1-800-627-8372). ←back to content

Footnote 11. Lounge visit fees will apply. Lounge fees are subject to change without notice. Payment is required with an eligible Wells Fargo Signify Business Mastercard®. Please refer to prioritypass.com/wellsfargosignify for enrollment and program details. Offers vary by airport location. All third-party products and services referenced herein are trademarks of their respective owners. ←back to content

Footnote 12. The cardholder is eligible for coverage in the event they suffer an accidental loss of life, limb, sight, speech, or hearing while on a covered trip. Common carrier fare must be paid in full with an eligible Wells Fargo Signify Business Cashservice mark Credit Card and/or rewards program associated with cardholder's covered account. Certain restrictions and limitations apply. Please review the Guide to Benefits for details. ←back to content

Footnote 13. Benefit is subject to terms, conditions and limitations, including limitations on the amount of coverage. Please reference the Guide to Benefits for details. Coverage is provided by New Hampshire Insurance Company, an AIG Company. ←back to content

LRC-0324