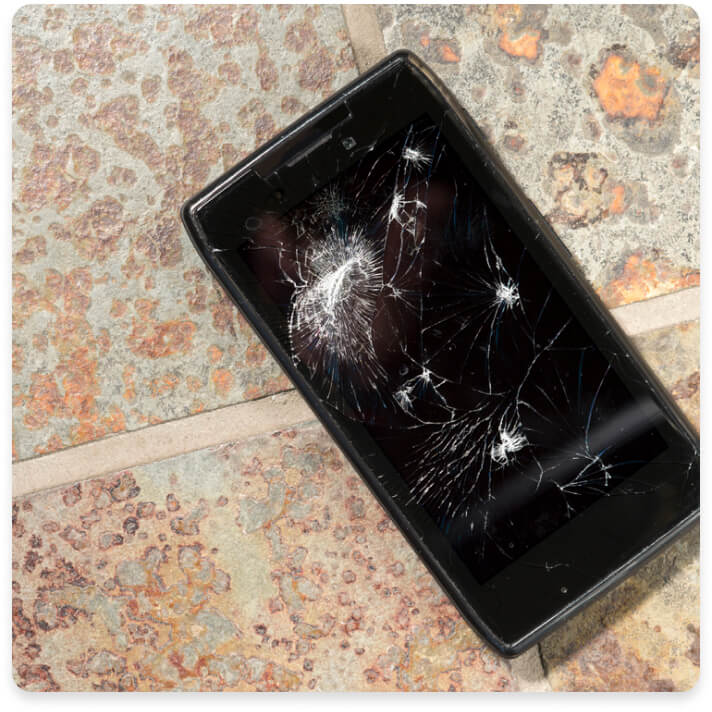

Did you know that credit cards often come with a variety of benefits, perks, and consumer protections? One of the more recent benefits is cell phone protection. Considering the significant cost of cell phones, you can gain some peace of mind knowing you have added protection in case your device is damaged or stolen.

Learn more about how credit card cell phone protection works, what you need to know about what is and isn’t typically covered, and why this perk is worth exploring when you’re considering applying for a credit card.

What is credit card cell phone

protection?

Credit card cell phone protection protects your phone in the event that it’s accidentally damaged or stolen. You can often find it included in the suite of perks provided by your credit card, similar to common benefits like purchase protection, rental car coverage, and trip cancellation protection.

Reduced costs on cell phone insurance

One big benefit about a card with cell phone protection is that it can save you from paying for coverage through your cell phone carrier. However, it’s important to look at the details of the cell phone protection so you’re aware of any exclusions and so you can decide if there is ample coverage for your needs. If you need more coverage, contact your mobile provider to learn about the available insurance options.

How to make a claim

In order to put in a claim, you’ll need to follow the credit card issuer’s prompts, which will lead you to their partner insurance service provider. They’ll likely ask you to provide documentation, including proof of your last cell phone bill payment via the credit card.

The insurance company that partners with your credit card company will either approve or deny the claim. If approved, you’ll receive reimbursement as a statement credit for the appropriate amount based on your claim.

Learn the terms of your cell

phone protection

Terms will apply to the cell phone protection, so it’s important to carefully read all of the fine print in your card’s guide to benefits. Review the coverage limits and whether there’s a cap on the number of times you can make a claim in a 12-month period. As with other types of coverage, your credit card phone insurance protection may also require you to pay a deductible.

A card that offers credit card cell phone protection typically requires you to pay your monthly cell phone bill with the card to be eligible for the coverage. Your coverage should begin in the next billing cycle following the first payment.

Look at your card agreement to see what is and what isn’t covered. For example, you may not be able to make a claim if your phone’s screen is cracked or if you lose your phone while traveling.

How does cell phone

protection work?

Cell phone protection works in a similar way to other insurance products you may already have, such as auto insurance. If your device is damaged during a covered event, you can file a claim. If the claim is approved, you are responsible to pay any deductible required. You’ll then receive a reimbursement payment at a set amount or enough to cover the damage.

What is covered by cell

phone protection?

Cell phone protection commonly covers the following:

Theft: If someone steals your cell phone, you can get reimbursed up to your maximum claim amount (or the cost to replace the phone if it’s less) minus your deductible. Note that the insurance provider may require you to file a police report and submit it as part of your claim.

Damage: If your cell phone no longer functions because of damage, then you can typically receive reimbursement for the repair costs. You’ll likely have to submit an itemized bill that shows how much it cost you to repair the phone.

The insurance will typically cover any phones included on the cell phone bill. For example, if you have three phone lines through a family plan, they should all be eligible for the insurance.

As for the particulars of your coverage, this can vary. That’s why it’s important to carefully read your card agreement. In addition to understanding what’s protection, review what isn’t covered and any exclusions to your insurance.

What isn’t covered by cell phone protection?

Here are some of the most common situations not covered by credit card cell phone insurance:

Losing your phone: Some cell phone protection plans do not cover your phone if you misplace it.

Cosmetic damage: Some protection benefits do not cover cracked screens or other types of damage that don’t impact the phone’s ability to function.

Losses from weather events: If your phone is lost or destroyed in a storm, cell phone protection usually won’t cover you. However, there may be other ways to be reimbursed through other types of insurance you may have, like your homeowner’s or renter’s insurance plan.

Cell phone accessories: Anything that was not included with your original cell phone purchase is not covered. You also won’t be covered for other non-phone devices that may appear on your cell phone bill, such as smartwatches or tablets.

Cell phone protection via a credit card is considered secondary coverage. This means that if you have cell phone insurance through your cell phone carrier or your homeowner’s or renter’s policies, the card benefit will kick in only after you exhaust that coverage.

Cell phone insurance also won’t cover any manufacturer defects, but your cell phone’s warranty should cover those issues. Warranty coverage will vary based on the manufacturer, so be sure to review these terms as well.

How do I find out if I have cell

phone protection with my

credit card?

To quickly find out if you have cell phone protection via your credit card, you can log in to your account and find the section that lists your card’s benefits. You can also call your credit card issuer or initiate an online chat (if available).

Cell phone coverage is still a fairly exclusive credit card benefit, so the card issuer may promote the perk on the card’s website. It’s also possible that you already carry a credit card with cell phone protection, so be sure to review your terms.

Should I get a credit card with

cell phone protection?

Credit card cell phone insurance is a helpful benefit for anyone who owns a mobile phone, especially if you have multiple people—and therefore multiple phones—on your cellular plan. If you want to make sure that you have some coverage for specific events like theft and damage, consider choosing a credit card with phone insurance.