Bilt Mastercard®

Finally.

A credit card that lets you earn points on rent.1 And more.

Offers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply now to take advantage of this offer.

REDEEM THE

MOST VALUABLE REWARDS

Bilt Points ranked as the most valuable rewards points (above Amex Membership Rewards and Chase Ultimate Rewards), by Bankrate.com

BEST

NO-ANNUAL-FEE CREDIT CARD

Winner of The Points Guy 2023 Readers’ Choice Awards for “Best No-Annual-Fee Credit Card”

1X POINTS ON RENT

PAYMENTS WITHOUT THE TRANSACTION FEE.1

Finally you can pay rent and get rewarded without the transaction fee.Example:

Rent

$2,000

Rent transaction fee (3%)

Waived for Bilt cardholders

old price $60

Illustrative

Even if your property only accepts

checks, you can still pay with your credit

card through the Bilt app and we’ll send

a check on your behalf.

2X POINTS ON TRAVEL1

Elevate the way you travel.

Earn 2X points on travel booked directly with airlines, hotels, cruise lines, and car rental agencies.

TRAVEL BENEFITS AND FEATURES:

Receive reimbursement for the nonrefundable cost of your common carrier fare if your trip is canceled or interrupted for a covered reason.3

Get reimbursed for eligible expenses incurred if a trip is delayed over six hours --benefit amount up to $200 per day, per traveler; maximum of $1,800 for all covered travelers.4

Pay for rental transactions with an eligible card and receive reimbursement of up to $50,000 if covered damage to or theft of your eligible rental vehicle occurs.5

No foreign transaction fee

When you use your card for travel, you won’t pay a foreign transaction fee for purchases converted to U.S. dollars.

Take 3 eligible rides with your Bilt World Elite Mastercard® in a month and earn $5 in Lyft credit.6

3X POINTS ON DINING1

Dine like a royal and earn 3X points whether you’re at your favorite restaurant, lounge, or ordering in.

DINING BENEFITS AND FEATURES:

Whether you need hard-to-find dinner reservations, the perfect last-minute gift or insider hotel recommendations, the World Elite Mastercard Concierge will work behind the scenes on your behalf — anywhere in the world.7

1X POINTS ON OTHER PURCHASES1

And it doesn’t stop there.

ADDITIONAL CARD BENEFITS:

Get up to $800 of cell phone protection per claim against damage, theft, and unintended separation when you pay your monthly phone bill with an eligible card. Subject to a $25 deductible.8

Get reimbursed for the cost to repair or replace an item purchased with your Bilt Mastercard in the event of covered damages or theft within 90 days of purchase.9

Protect your available credit

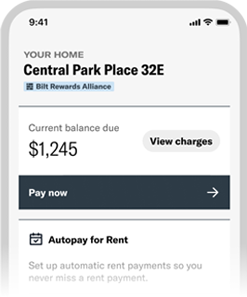

with BiltProtect

BiltProtect lets you pay rent without using your credit limit, by pulling the full rent payment directly from a linked bank account. By using BiltProtect, you agree to the Terms & Conditions.10 You still earn 1X points on rent payments. Use the card 5 times per statement period to earn points, up to 100,000 points per calendar year. Terms apply.1

BILT REWARDS

Use your points for all your favorite Bilt Rewards redemptions.

Points earned with the Bilt Mastercard® will also count towards your Bilt Rewards status.

Travel

Transfer your points 1:1 to one of our many world-class partners.

Rent and down payment

Use your Bilt points towards a credit on your next month’s rent statement or save your points and put them towards a down payment - with the first rewards program of its kind to let you redeem rewards points towards homeownership.

Fitness

We’ve partnered with the nation’s top group fitness classes so you can redeem your points for some of the most popular classes – starting at just 1,600 points a class.

The Bilt Collection

With the Bilt Collection, you’ll have exclusive access to our hand-curated catalogue of art, decor, and apparel — all inspired by that month’s featured artist.

“If you’re looking for a way to earn rewards on rent payments, this card is the obvious choice. It not only earns points on rent, but also waives the fees that typically come with paying rent with a credit card.”

“For any renter, the Bilt Rewards program and Bilt Rewards Mastercard® is a no-brainer. Bilt allows you to capitalize on the routine rent payments you already make each month by earning points.”

“In an industry where lots of credit cards share many of the same features, the Bilt Mastercard is a rare product that has a compelling feature that no other card is currently able to offer."